Leave a gift in your will

When the time is right to remember a charity in your will, remember the Society.

You can gift an item, money or a share, percentage, or fraction of an estate. Every gift in every will, however large or small, makes a difference.

Thanks for reading about gifting in your will. Take action today and you’ll have the peace of mind of knowing your wishes will live on. This will transform the work that we can do in the future.

You can gift:

- An item;

- Money;

- A share, percentage or fraction of an estate.

Donate an item

We hold monographs, journals, photographs, artwork, maps, atlases, globes, artefacts and manuscripts.

Our Principal Librarian, Eugene Rae, considers all potential donations to these holdings. For more information on our collecting policy, please contact him via email at enquiries@rgs.org

Sponsor conservation

We have an ongoing programme to preserve our Collections. If you would like to make a donation towards conservation activities, or sponsor the conservation of a specific item, please contact our Deputy Librarian Jan Turner at enquiries@rgs.org

How to leave a gift to the Society in your will

Do you know you can just phone your solicitor with a charity’s name and registered charity number?

It can be done in minutes. You'll need the following details:

- Charity name: Royal Geographical Society (with the Institute of British Geographers)

- Registered charity number: 208791

- Registered address: 1 Kensington Gore, London, SW7 2AR

For an informal and confidential discussion about how to support the Society through a gift in will legacy gift, please contact Christine Quigley via phone on +44 (0)20 7591 3007 or email development@rgs.org

Large or complex estates

If you have a large estate above the inheritance tax threshold, or if you have a complex estate (e.g. trusts or foreign assets) or have a dementia-related illness or on high medication you should speak with a solicitor.

You can find a local solicitor using the Law Society website.

Information for executors of a will

If you are an executor of a will and have questions relating to a gift that has been left to the Society, please read our detailed information for executors of wills.

Will writing service

We work with Make A Will Online to help our supporters turn their intentions into a reality. You can go to Make A Will Online's website and follow the instructions to get a solicitor checked will safely and securely for the cost of £60.

You can also protect your will from challenge with free access to Capacity Vault, the best way to protect the wishes in your will online. We get to know a will has been made and if you give GDPR consent we will be able to thank you too.

Privacy notice

When you use this service using the link above we find out information that is very useful for our campaigns: e.g., when a will is made, how much is pledged, the types of gifts and your name, year of birth, email and address. Where you provide consent, we are able to say thank you and keep in touch.

There is no obligation to leave a gift to charity.

We know that some of our supporters want to make a will and leave a gift completely confidentially without us finding out about this. If you want to do this you can use this link to make a will online.

Whichever way you choose to remember us we are incredibly grateful.

Make a will in person

If you would rather speak to a solicitor face to face you should do so.

Please make sure your solicitor uses our full details:

- Our name: Royal Geographical Society (with the Institute of British Geographers)

- Our charity number: 208791

- Our registered address: Royal Geographical Society,1 Kensington Gore, London SW7 2AR

Make A Will Online

Make a lasting difference. Ensure your values live on and get a solicitor-checked will with Make A Will Online.

The Fundraiser Regulator

The Fundraising Regulator is the independent regulator of charitable fundraising in England, Wales and Northern Ireland. Find out more about what they do and their vision.

Work made possible through gifts in wills

Esmond B. Martin Royal Geographical Society Prize

Our annual Prize recognises outstanding achievement in the pursuit of geographical research, with a particular emphasis on wildlife conservation and environmental research studies.

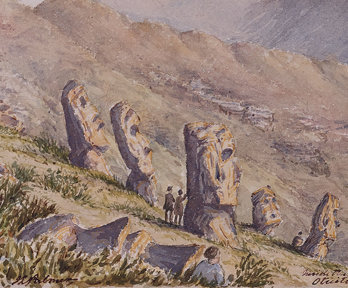

John Linton Palmer Rapa Nui album

Open the recently restored travel album from naval historian John Linton Palmer, which enhances our understanding of the visual culture of global maritime exploration.

The British Society for Geomorphology (BSG) - Marjorie Sweeting Dissertation Prize

Learn more about The British Society for Geomorphology (BSG) - Marjorie Sweeting Dissertation Prize and how to apply. The award is presented at the Annual General Meeting.