Over a short period of time the development of unconventional oil and gas in North America (both in the United States and Canada) has had a dramatic impact on the global energy system. Although the development of the techniques that have allowed this took decades to perfect, in less than a decade the United States (US) has gone from expecting to be a significant importer of natural gas to planning to export gas by the end of this decade (and probably earlier).

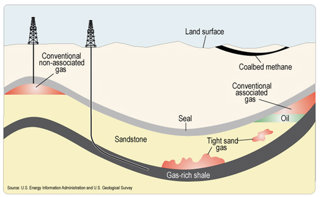

Domestic oil production has also rebounded and some, such as BP, predict that the US could become a net oil exporter in the 2020s. This interview uses the term ‘unconventional oil and gas’ to highlight the fact that these new production techniques are being used to develop both shale oil (or tight oil as it is known in the US) and shale gas, as well as Coal-Bed Methane (drilling in coal seams to extract gas) (See Diagram one).

Diagram one: Geology of Natural Gas Resources

How does the hydraulic fracturing process work?

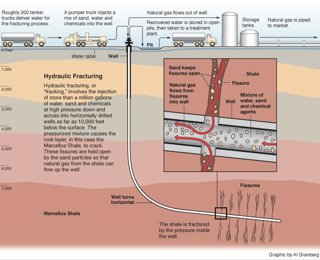

It has long been known that shale contains oil and gas resources, these rocks are the source of conventional forms of oil and gas, however, the hydrocarbons are trapped within the fabric of the shale rock and it is necessary to fracture the rock and hold open those fractures to allow the oil and gas to flow. Two technologies are now being used in combination to access the oil and gas in shale rocks: horizontal drilling and high volume hydraulic fracturing (HVHF). Both technologies are well established in the global oil and gas industry where they are used to develop conventional oil and gas deposits and enhance production from existing fields. This is important because the oil and gas industry does not consider these technologies to be new and risky. As illustrated in Diagram 1, conventional drilling involves vertical wells that simply drill down into an oil or gas reserve; horizontal drilling involves turning drill to drill horizontally. Horizontal drilling is important because it increases the area of the shale deposit that can be subjected to HVHF, thus increasing the rate of production. Some of the world’s longest horizontal wells are more than 11 km long. The second technology—HVHF—involves forcing water, sand and chemicals (so-called fracking fluids that are about 0.5% by volume) down the well at very high pressure to force open fractures in the shale rock. The sand is used as a ‘proppant’ to hold open the small fractures in the rock to enable to oil and gas to flow. The term ‘high volume’ is used as the process uses more water than is the case with conventional oil and gas production. Once the well has been ‘fractured’ some of the water used returns to the surface (so-called produced water) and contains the fracking fluids and other material that has been added underground and requires treatment and/or disposal. The final stage is that of production that will continue for 20 years or more, initially at high rates, but this falls off quite rapidly with low production rates expected for decades. Diagram two summaries the various stages in the process from initial drilling to production.

Diagram two: The Shale Gas Production Process.

Why is this process so controversial?

From now on I will focus on shale gas as this is the issue that is causing current concern in the UK. However, it is important to note that shale oil production could also be important in the UK, particularly in the southern regions of England (the Weald Basin). The UK Government department that has been created to deal with these issues is called the Office of Unconventional Oil and Gas or OUGO.

As I noted above, the technologies used to develop shale gas are not new to the industry, but they are new to the public. It is also the case that shale gas production is very different from conventional gas production (the vast majority of which is located offshore in the UK); it is an industrial process that requires lots of wells to be drilled on a continuous basis. The very term ‘fracking’ sounds alarming and provokes concern on the part of the public. Shale gas development in the UK is at a very early stage and it is for the Government and the Industry to convince the public that it can be done safely and that the benefits outweigh the costs. This is sometimes called the ‘social licence to operate.’ Public acceptance has not been helped by the negative media coverage coming from the US in films like ‘Gaslands’ and the environmental movement in the UK has been very vocal in its opposition to the commercial development of shale gas (and oil) in the UK. Those in favour of development stress the benefits that it can bring in terms of energy security and economic development (jobs and investment); while those opposed stress the negative environmental impacts, both locally in areas of production and globally in terms of climate change (natural gas is methane which is a greenhouse gas). The result of all of this in an entrenched and on-going public debate about the wisdom of shale gas development in the UK, with the media fanning the flames of disagreement.

What are the environmental concerns associated with this process?

Like any industrial process, shale gas development has environmental impacts. None of these impacts is new or unique to shale gas. The combination of risks that need to be managed are new to regulators in the UK, but the position of the UK Government is that the necessary regulations are in place to insure the safe development of shale gas. If we follow the production process, the first set of environmental concerns is associated with the drilling process (remember that over 2,100 wells have been drilled onshore in the UK over the last 100 years, largely without incident). The drilling bore passes through the aquifer—the layer of water bearing rock—and needs to be isolated from the surrounding rock so that fluids and gas do not leak, this is known as ‘well completion.’ The drilling and HVHF processes have triggered small-scale seismic events (earthquakes) and this did result in the 18-month suspension of shale gas drilling in the UK following events at Preese Hall near Blackpool in April 2011 that triggered two small earthquakes, the largest being 2.3 on the Richter scale. Research in the US suggests that it this is a rare occurrence and that most ‘induced seismicity’ as it is called is a result of injecting wastewater underground. Following the Preese Hall events a traffic light system has been put in place to manage this risk.

Another set of concerns is related to the water used in HVHF. First, the process itself uses a lot of water, but no more than other industrial processes and certainly less than thermal power stations. However, that water has to be sourced and there are areas in the UK where water resources are already under significant stress and shale gas would have to compete with existing users. Second, and a bigger concern, is the waste management challenge associated with HVHF, the produced water needs to be treated and this will put a stress on existing facilities. The industry is moving to reduce the volume of water used and also to reuse water as much as possible. Third, is the possibility that poor well completion will contaminate the aquifer and water supplies for other consumers—agriculture, industry and households. The industry and the regulators need to convince the public that there will be adequate (independent) inspection of wells to insure that this does not happen.

Above ground there are concerns related to air pollution and to noise and disturbance. The air pollution concerns are of at least three types: first, so-called ‘fugitive emissions’ that is the leakage of methane into the atmosphere in the production process (remember that methane is a greenhouse gas). This is an important issue as it relates to claims that shale gas in a clean fuel, relative to importing gas from distant places (such as Russia and Qatar) and this it is cleaner than coal when burned in power stations. There is lot of controversy around this issue and the position of the UK Government and the EU is that the level of emissions are not significantly greater than conventional gas production, which is not the same thing as saying they don’t happen. Second, at a local scale the drilling and fracking operations generate local air pollution concerns, just like any other industrial facility, and this will require monitoring. Third, environmentalists are concerned that shale gas production (which is just the same as conventional gas once it is in the pipeline system) will not replace coal, but will augment it and will lock the energy system into a higher carbon future than demanded by the UK’s climate change legislation (an 80% reduction by 2050). They also suggest that investment in shale gas may reduce investment in renewable forms of energy supply. The net result being that shale gas development in the UK is not going to help to reduce carbon dioxide emissions. Not surprisingly, both the UK Government and the Industry disagree and shale gas development is consistent with climate change policy.

The final set of concerns that relate to the impact of this is industrial activity on local communities. The drilling and fracking stages require the movement and installation of a lot of heavy equipment and the supply of materials. Experience in the US shows that this results in high levels of truck movements that are a local nuisance and can damage the road system. The fracking operation generates a lot of noise on a 24/7 basis. The industry points out that this stage is relatively short-lived in the life-cycle of each well. However, in the UK we anticipate multiple wells being drilled at each site, added to which the thickness of the shale deposits means that each well will be subject to more fracturing. The net result may be that the well pad (the name give the production site) will be operating for longer than is the case in the US and may even become a semi-permanent installation. This would significantly increase the local impacts of the shale gas development. Much is being made of the employment opportunities created by shale gas development, but experience in the US suggests that these are specialist jobs, often using subcontractors that move from well to well, and that relatively few local jobs are created. No doubt further up the supply chain jobs will be created, but those benefits are unlikely to be in the localities most affected by shale gas development. Again, research in the US suggests that the geography of the winners and losers is often quite different. As a final word, while it might seem that there are a host of problems associated with shale gas development, it is important to understand that all forms of energy production come with environmental costs and all industrial processes create concerns that require monitoring and regulating. Shale gas can be considered as a new industrial process that is being proposed in the UK and the costs and benefits and who pays the costs and who reaps the benefits require careful consideration before we go ‘all out for shale’ to paraphrase the Prime Minister David Cameron.

How has the increase in Shale Gas production impacted on global energy markets?

This is a complicated issue and it is important to understand that large-scale commercial production of shale gas is currently confined to North America (production of coal-bed methane is much more widespread). The North American gas market (Canada, US and Mexico) is essentially a self-contained market with no exports and modest imports. The first impact that US shale gas production had was to reduce the need to import natural gas. Less than a decade ago it was expected that the US would have to important significant quantities of Liquefied Natural Gas (LNG) from abroad and a large number of terminals were built to receive the LNG. Now, the US is more or less self-sufficient in natural gas, though small quantities still go the eastern seaboard to supply areas that are not connected to the domestic pipeline system. Two things have happened as a result of the loss of the US as market for LNG. First, producers such as Qatar had invested in new production facilities to supply the US market and this LNG has had to find new markets. Initially this was in Europe, but after the Fukushima disaster in Japan, most of that gas now goes to Japan and other Asian consumers (China, South Korea and Taiwan). Second, owners of those LNG import terminals in the US are looking to convert them into export terminals, which requires the installation of liquefaction trains that cool the gas to -160oCm when it becomes a liquid that occupies 600 times less volume, making it profitable to transport in specialist ships—LNG tankers. There are over 20 LNG export terminals proposed in the US and another 15 or so in Canada. At the same time, the availability of cheap natural gas in the US has resulted in the power generation companies switching from coal to gas. This has also help reduce US carbon emissions. Unfortunately, the US coal industry has increased its exports and cheap coal from the US has been imported into Europe where power generation companies are using it instead of gas (which is much more expensive than in the US) and this is increasing carbon emissions. This is happening in the UK and in 2013 gas consumption was at the lowest level since 1995, while gas use in power generation has fallen. This has happened because the cost of carbon on the European Carbon Trading System is too low to stop coal being burnt. Thus, an unintended consequence of shale gas development is increased coal consumption and depressed gas demand in Europe! The next stage will see the export of LNG from the US, but at the moment it seems likely that most of that LNG will be destined for Asian markets, despite the assertions by some politicians in the US and Europe that US LNG exports can help to reduce the EU’s reliance on Russian gas imports. The reality is that the gas will go to the customers who are willing to pay the most for it and that Russian pipeline gas in Europe will probably be cheaper than imported LNG from the US.

Is there likely to be a ‘Shale Gas revolution’ in the UK?

There is no doubt that there are significant deposits of shale in the UK and the British Geological Survey has estimated large amount of ‘gas in place’, but we are a long way from knowing how much gas can be produced under UK operating conditions. Only a handful of exploratory wells have been drilled so far (and, according to a recent House of Lords report, only one has been hydraulically fractured) and we need to know a lot more about the shale resource potential before we can start to make realistic assertions about the prospects for commercial development. The UK Government has said that it would like to see 30-40 exploratory wells drilled in the next 2-3 years. This is a modest start, but it will begin to answer the questions about the amount of gas in the rock and how well that gas will flow when subjected to HVHF, only then will be able to assess the prospects for the future. If all goes well, and there is public acceptability of shale gas (and oil) development, we are still unlikely to see substantial commercial development until the 2020s. It will take time to develop the necessary supply chain to provide the equipment and construct the infrastructure to connect producing wells to processing facilities and then to the national transmission system. There are wide range estimates about how much shale gas might eventually be produced, but it may not be sufficient to compensate for the falling production of conventional gas in the North Sea. In such a situation, depending on how much gas we consume; we may still have to import the majority of our gas from abroad. Thus, shale gas can make a contribution to UK gas security, but it is unlikely to be of a game changing or revolutionary nature.

What factors are likely to affect the development of shale gas production in the UK?

We have a good understanding of the factors that enable to development of shale gas in the US and key factors include: extensive geological knowledge, tax incentives to develop the techniques, the availability of drilling rigs and a well-developed oil and gas service industry; regulatory exemptions, private ownership of the subsurface mineral rights, availability of finance and the existence of a well-developed continental gas pipeline system. From what was said above, it is clear that many of these are lacking in the UK, we don’t have the necessary knowledge, we have very limited onshore oil and gas capacity, the subsurface rights generally belong to the Crown (this means that the surface landowner has no incentive to allow drilling on their land) and the regulatory regime is far more complex and getting the necessary approvals far more time consuming (which means it costs more money) than in parts of the US, where some states support fracking whereas other states do not. The UK Government is providing tax incentives and local communities will receive payments from shale gas development, but both are proving controversial. All of these differences are leading many to doubt if the Government and the Industry can generate the necessary head of steam to get beyond the exploration phase, or even complete that phase, in a timely manner and with public support.

Are there any other methods, other than hydraulic fracturing that the UK could use to contribute to its energy security?

Energy security is about securing energy resources at prices that are affordable. It is generally assumed that domestic energy production is more secure than reliance on imports (but that assumes adequate investment in capacity) and that it is better to diversify your sources of supply of imports. The UK has a diverse and resilient gas supply system. We still have significant offshore gas production that is supplemented by pipeline imports from Norway (57% of our imports in 2013) and from continental Europe via two interconnector pipelines (23.1% in 2013). These imports are supplemented by LNG imports (19.2 % in 2013) that come to three terminals and are largely from Qatar. However, as domestic production has declined, so our import dependence has increased (it 61% in 2012, but fell to 58% in 2013 as a result of decreased consumption) and we have been increasingly exposed to supply interruptions (largely technical) and price volatility. In this context, the UK Government rightly suggests that shale gas production will contribute to the UK’s energy security, as it will reduce the amount of gas we import and also we will benefit from not having to pay for those imports.

However, the other way that we can improve our energy security in relation to natural gas is to reduce the amount that we consume. In the UK gas is used in three sectors in roughly equal portions: power generation, industry and households (heating and cooking). We can reduce gas demand by finding alternative ways of generating electricity, preferably not more coal, but low carbon sources such as nuclear power and renewable electricity (primarily wind and solar). However, we will still need to retain a certain amount of gas to provide electricity when the wind does not blow. Such changes in the power generation sector will happen as we decarbonise our electricity supply. In the household sector gas is used for space heating and cooking. It is assumed that in the future this will be replaced by electricity that will be generated from low carbon sources, but this will take time to achieve. Meanwhile we can improve the energy efficiency of our homes by replacing old inefficient gas boilers and improving insulation etc. No doubt industry can make similar efficiency savings, but gas also remains an important raw material. Thus, there are all sorts of ways that we can reduce overall gas demand and these bring added benefits to the consumer and help to achieve our carbon reduction targets. We are still going to need a significant amount of gas moving forward over the next decade or so, but we need much more careful analysis and reflection before we can decide if shale gas is part of the solution.

Michael was interviewed in May 2014